Growth in Europe and Central Asia expected to weaken further in 2015: World Bank

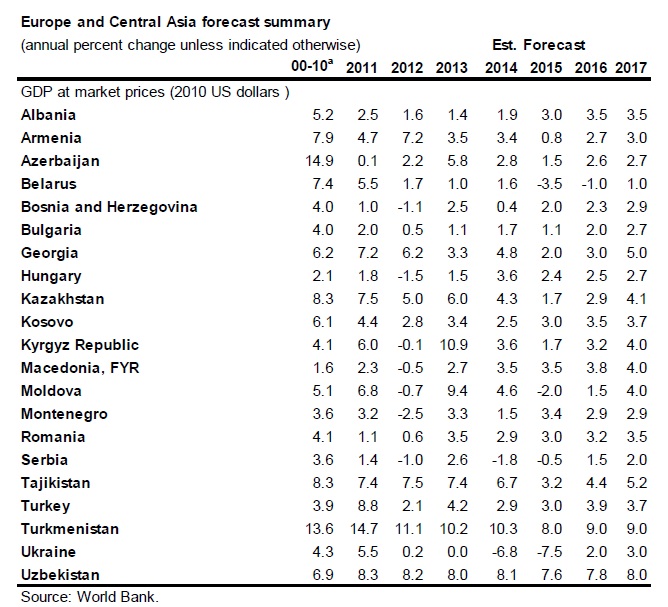

After slowing to 2.4 percent in 2014 from 3.7 percent in 2013, growth in the developing Europe and Central Asia (ECA) region is expected to weaken further in 2015, the World Bank says in its report on “Global Economic Prospects.”

This reflects the impact of plunging oil prices and geopolitical tensions, and related spillovers, including from Russia, which outweighed a moderate recovery in the Euro Area and the benefits from low fuel prices to net fuel importers. Growth in Russia continued to slide in 2015, following a modest 0.6 percent expansion in 2014 as falling incomes hurt consumer spending. Investment is also under pressure due to weak business confidence, tighter financing conditions, and restricted access to international capital markets as a result of sanctions.

In the eastern part of the region, where almost all countries have been negatively affected by the spillovers from lower oil prices and geopolitical tensions, growth slowed sharply to 1.5 percent in 2014. In Kazakhstan, growth declined to 4.3 percent in 2014, and continued to ease in 2015 despite fiscal stimulus. In Ukraine, output contracted by 6.8 percent in 2014, reflecting a deep decline in the conflict-affected East and a moderate recession in the rest of the country. The regional headwinds had significant negative repercussions on the region’s oil-importing economies, especially on Belarus and Moldova, through declines in trade, investment, and remittances, which more than offset the benefits of low oil prices.

In the western part of the region, as a result of close integration with the Euro Area, a stronger-than-expected recovery in the Euro Area offset other challenges. Growth accelerated to 2.8 percent in 2014, led by the EU’s new member states. Across the sub-region, legacies of the global financial crisis continue to weigh on the recovery, especially still-stretched balance sheets (Bulgaria, Serbia and to a lesser extent Romania).

Outlook: The outlook for the region has deteriorated markedly, with growth in developing Europe and Central Asia expected to drop to 1.8 percent in 2015. However, recently, confidence has improved slightly, reflecting the stabilization of oil prices, the peace agreement reached in Ukraine, policy measures implemented in several economies, and a stronger-than-expected recovery in the Euro Area. Assuming stabilizing oil prices in 2016-17, effective macroeconomic and growth-stabilizing policy actions, and no further deteriorations of the geopolitical climate, regional growth is expected to strengthen to an average of 3.5 percent in 2016-17.

In Russia, a contraction in economic activity by 2.7 percent in 2015 is expected to be followed by a modest recovery in 2016 as policies facilitate adjustment to a new low oil price environment. In Kazakhstan, growth is projected to decline to 1.7 percent in 2015 as production delays in the Kashagan oil field persist, but strengthen to an average of 3.5 percent in 2016-17. Ukraine’s economy is expected to contract by 7.5 percent in 2015, and the prospects for recovery in 2016-17 are highly uncertain, but improving. The ceasefire agreement signed in February and the IMF four-year support program helped stabilize currency and financial markets in Ukraine.

The western part of the region is expected to see growth remaining flat in 2015 at 2.8 percent, below the region’s potential and insufficient to significantly reduce high and persistent unemployment. Activity is projected to strengthen gradually to 3.3 percent in 2016-17 as the Euro Area gains momentum.

In Turkey, growth is projected at 3 percent in 2015 despite a subdued first half. Private spending is expected to recover after the June elections, assuming that political uncertainty is resolved. Soft fuel prices and robust exports will likely contribute to a further reduction in Turkey’s trade deficit.

Risks: Key risks to the region include further declines in oil prices, escalation of geopolitical tensions, and abrupt tightening of financial conditions. Any faltering in the global economic recovery, especially in the Euro Area, and an unfavorable resolution of problems between Greece and its creditors would pose risks to the region’s anticipated expansion. A disorderly adjustment in global financial markets to the expected tightening of U.S. monetary policy could disrupt financial markets in the region. Turkey and other economies in Central Asia remain particularly exposed as their economies rely heavily on dollar inflows.